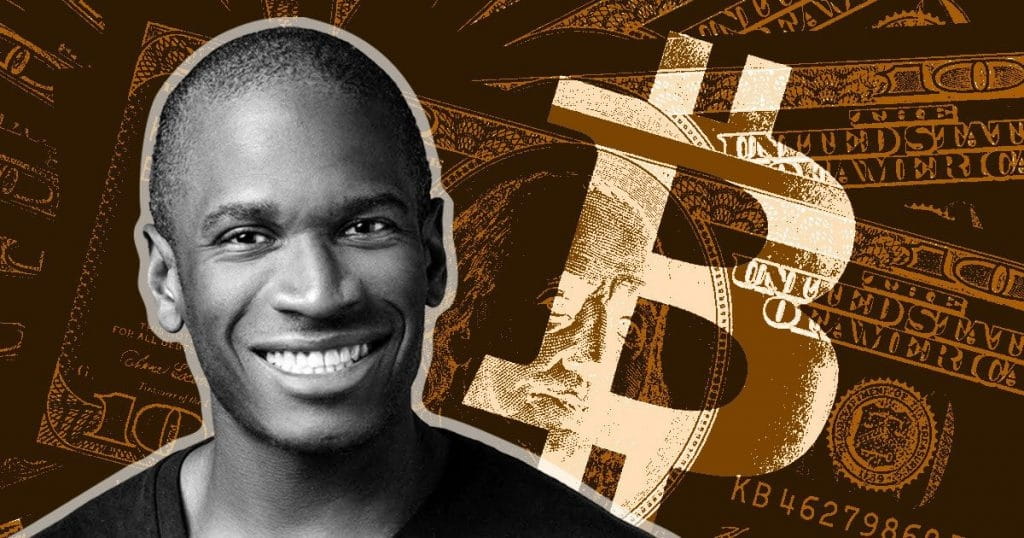

At the Black Blockchain Summit, BitHub Africa Africa had the privilege of hosting an exclusive fireside chat with Arthur Hayes, one of the most influential figures in cryptocurrency trading. This conversation, moderated by John Wainaina Karanja, reveals the extraordinary journey that shaped one of Bitcoin’s most prominent advocates.

From Buffalo to Wall Street: The Making of a Visionary

Arthur Hayes’ story begins in Buffalo, New York, where he was born to parents working in the automotive industry. His family later moved to Detroit before returning to Buffalo for his high school years. But it was during these formative years that Hayes demonstrated the strategic thinking that would later revolutionize crypto derivatives.

“When I was a senior in high school, I read a book about traders in Japan during the early 2000s,” Hayes recalls. “I thought, ‘Japan was the opportunity from 1970s to 1989, so who’s the new kid on the block?’ That’s China.”

This insight led Hayes to make a pivotal decision: learn Chinese and position himself in what he saw as the next great economic opportunity. It’s this type of forward-thinking analysis that would later make him a pioneer in Bitcoin derivatives trading.

Strategic Education Choices That Changed Everything

Hayes’ acceptance to the University of Pennsylvania’s prestigious Wharton School was just the beginning. He dedicated five days a week to Chinese language classes, preparing for what he knew would be a transformative experience in Asia.

His junior year study abroad at Hong Kong University of Science and Technology (HKUST) proved to be life-changing. “I fell in love with the city,” Hayes explains. “I traveled to China, Thailand, and Singapore. I decided I wanted to move to Hong Kong.”

Breaking Into Asian Finance Markets

Through the Sponsorship for Educational Opportunity (SEO) program, which helps minority students access Wall Street careers, Hayes secured an internship at JPMorgan. However, his vision extended beyond traditional American finance.

When JPMorgan couldn’t convert his New York offer to Hong Kong, Hayes took matters into his own hands. “I cold-emailed every single top-ranked investment banking internship program,” he reveals. This persistence paid off with a Deutsche Bank offer for their Hong Kong equity derivatives sales desk.

The Hong Kong Advantage: Why Location Matters in Crypto

Hayes arrived in Hong Kong during the summer of 2007, just as the Hang Seng Index was hitting 30,000 points. “Hong Kong has this window where Western capital and Chinese capital can mingle,” he observed.

This international perspective would prove crucial for his later success in cryptocurrency markets. Hong Kong’s position as a bridge between East and West mirrors Bitcoin’s role as a bridge between traditional and digital finance.

Building Networks in an International Hub

“Nobody is at home in Hong Kong except the Cantonese people,” Hayes explains. “You have this international mix from all over the world. Some of my closest friends – we all interned together, were roommates, worked together on the trading floor, and started businesses together.”

This network of international finance professionals, formed during the 2007-2009 period, would become instrumental in Hayes’ later ventures in cryptocurrency trading and BitMEX’s development.

Lessons for African Crypto Entrepreneurs

Hayes’ journey offers valuable insights for African entrepreneurs looking to make their mark in cryptocurrency and blockchain:

- Think Globally Early: Hayes identified emerging opportunities while still in high school

- Invest in Language and Culture: Understanding different markets requires cultural immersion

- Leverage International Hubs: Position yourself where capital and opportunity intersect

- Build Diverse Networks: Success often comes through connections with people from varied backgrounds

- Time Market Cycles: Hayes arrived in Asia just before major financial shifts

The Foundation of a Crypto Pioneer

While this fireside chat continues with Hayes’ experiences during the 2008 Lehman Brothers collapse and his eventual journey into cryptocurrency, his early strategic thinking provides crucial lessons for today’s blockchain entrepreneurs.

Hayes’ ability to identify emerging markets, adapt to new cultures, and build international networks laid the groundwork for his later success in creating one of the world’s most influential Bitcoin derivatives platforms.

His story demonstrates that success in cryptocurrency often requires thinking beyond traditional boundaries – whether geographical, cultural, or financial.

Key Takeaways for Crypto Success

Hayes’ early career reveals several principles that remain relevant for today’s crypto entrepreneurs:

- Identify tomorrow’s opportunities while others focus on today’s trends

- Develop genuine cultural competency in emerging markets

- Build relationships across diverse international communities

- Position yourself at the intersection of different economic systems

- Maintain long-term vision despite short-term challenges

As BitHub Africa Africa continues to bridge traditional African finance with cryptocurrency innovation, Hayes’ journey from Buffalo to becoming a Bitcoin trading legend offers inspiration and practical insights for the next generation of African blockchain pioneers.

Stay tuned for Part 2 of this exclusive fireside chat, where Hayes discusses his experiences during the 2008 financial crisis and his eventual entry into cryptocurrency trading.